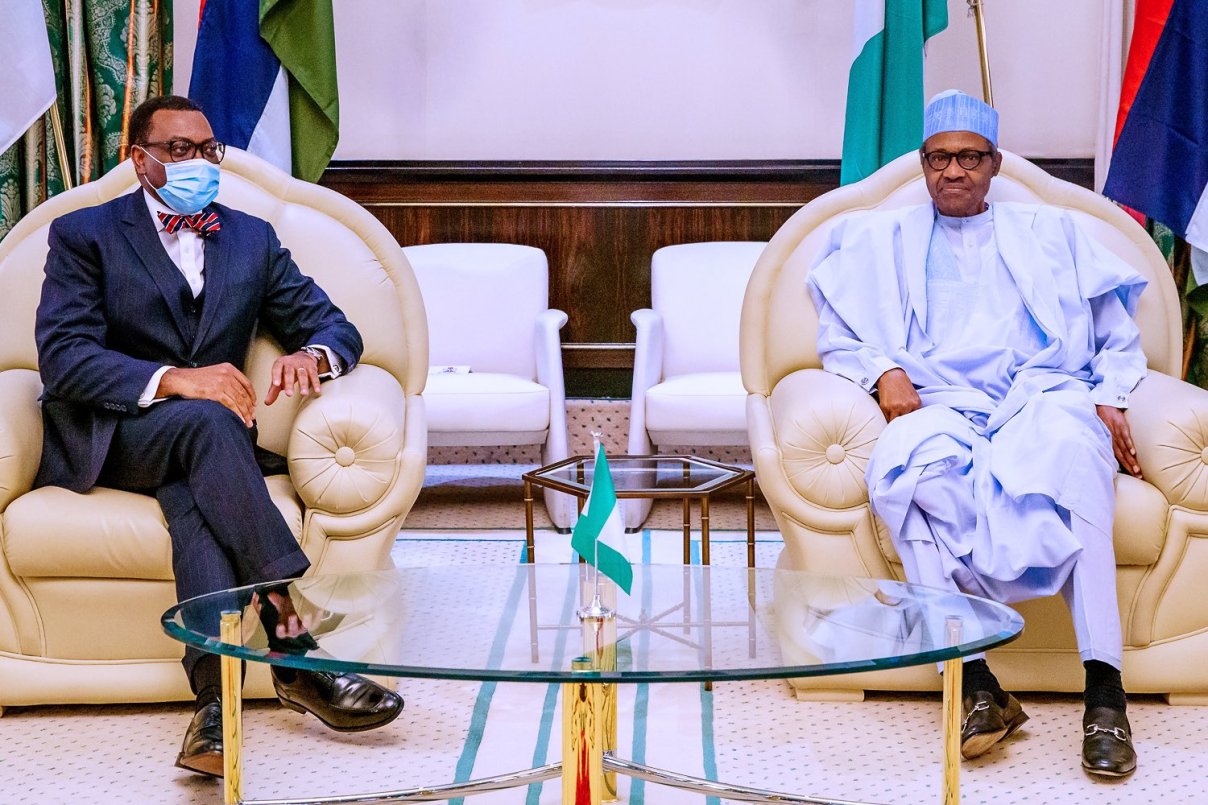

L-R Executive Chairman, FIRS, Tunde Fowler and Chairman, Bauchi Internal Revenue Board, Jibrin Hussain Jibo during Jibrin courtesy visit to FIRS on Wednesday. Photo credit/FIRS

FIRS, Bauchi Internal Revenue Board Tighten Co-operation

- FIRS, SBIRSs to share data on taxpayers

The Federal Inland Revenue Service (FIRS) and State Boards of Internal Revenue (SBIRs) have agreed to further close ranks, share information and knowledge on how to increase tax revenue receipts at both the Federal, State Local Government levels.

Fowler also reiterated that the FIRS and State Boards of Internal Revenue (SBIRs) are to share data on taxpayers to ensure effective and seamless tax administration in Nigeria by the end of the month.

At his courtesy visit on Wednesday to the FIRS headquarters in Abuja, the Chairman, Bauchi Board of Internal Revenue (BBIR), Jibrin Hussain Jibo, said that Bauchi state has benefited much from deploying tax administration initiatives of the FIRS, urging the FIRS to continue supporting the BBIR with ideas and innovations.

The Executive Chairman, FIRS, Tunde Fowler, said FIRS would not hold back any initiative that would help states to do better in terms of tax administration and revenue collection.

Fowler encouraged State Boards of Internal Revenue (SBIRs) to also consider staff welfare as well as other ideas that will increase revenue collection. He noted that exchange of information on taxpayer base between FIRS and SBIRs will be done through the Joint Tax Board (JTB) Secretary in order to ensure that taxpayers within the states are adequately captured.

“FIRS sees tax administration in Nigeria as not only Federal-driven. As a result, FIRS strives to share new ideas that it comes up with at the JTB. This was demonstrated recently by the signing of an MOU on cooperation between the FIRS and State Internal Revenue Boards”, he said.

Fowler highlighted some of the achievements of the FIRS which he invited the Bauchi team to take advantage of: “FIRS has deployed ICT solutions to ease tax administration especially for the benefit of the taxpayer. Taxpayers will no longer need to come to the FIRS office to do their tax transactions. They can access Stamp Duties and download receipts amongst several other functions on the website”, Fowler said.

He stated that FIRS also takes it upon itself to educate Nigerian youths some of whom he said are not used to paying tax and has come up with publications for taxpayer education secondary schools.

The ECFIRS further noted that FIRS has improved considerably in its revenue collection by exceeding its target and expressed its willingness to share and exchange information and ideas with the Bauchi state team.

Jibo, a former staff of FIRS described his visit as ‘homecoming’ and said the opportunity to lead the delegation of directors of the Bauchi State Internal Revenue Service to the FIRS was a great pleasure and a rare opportunity for his staff.

According to Jibo, there is no gainsaying that the FIRS under the leadership of Fowler has achieved a lot. He expressed his belief that there is a connection between the outstanding performance in the FIRS and the recognition given to FIRS staff by most state governments who prefer FIRS staff to chair their SBIRs.

Jibo said: “Some achievements of the Bauchi State Internal Revenue Service are increase in revenue collection to about 30 percent to 40 percent, the creation of new Area Offices, successful enforcement activities, staff welfare in terms of upgrade via promotion, work with MDAs in community impact programs and audit functions. We must thank the FIRS for your continuous support while we are looking forward to a greater working relationship”.

The JTB Secretary, Oseni Elamah enjoined Jibo to put in his best at Bauchi revenue board to earn the confidence of Nigerians. Oseni noted that it was Fowler’s star performance in Lagos Internal Revenue Service that earned him the presidential confidence to be the Chairman of the FIRS.

Recent Comments