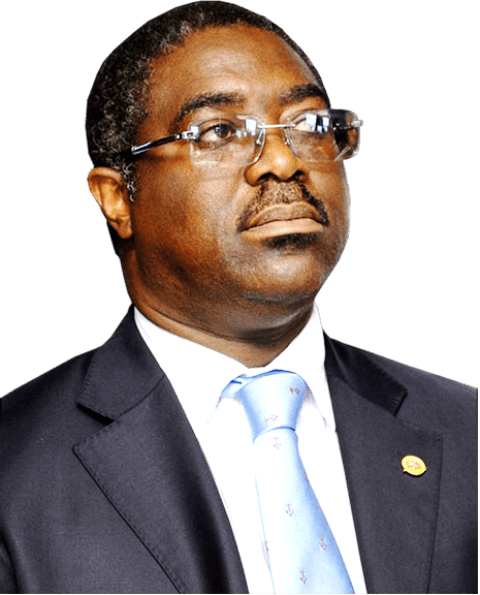

Vice President Yemi Osinbajo (in white) with Tunde Fowler at the opening of 20th CITN Conference on tax at the NAF Center, Wednesday in Abuja. Photo/FIRS

Nigeria: 5 Tax Amendment Bills, 2 Executive Orders Coming, Says VP Osinbajo

Five Tax Amendment Bills and two Executive Orders are coming, Nigeria’s Vice President Yemi Osinbajo announced Wednesday in Abuja.

The tax Bills and Executive Orders are aimed at simplifying tax payment process and reducing tax burdens on Small and Micro Enterprises (SMEs) in the West African country.

ALSO READ:

HOW FOWLER WILL SHAPE AFRICA’S ECONOMY IN 2018

Safe Nation Needs Economic Prosperity, Fowler Tells NDC Class

The Vice President said the Federal Government’s Committee on the National Tax Policy (NTP) had drafted the five amendment bills and two Executive Orders all of which will be presented to the Federal Executive Council (FEC) for approval. This is in collaboration with states and other stakeholders to ensure that Nigeria’s tax laws and the NTP are friendly and realistic.

A statement on Wednesday by the Head, Communication and Servicom Department of the Federal Inland Revenue Service (FIRS), Wahab Gbadamosi, quoted Osinbajo to have said: “Our tax system requires review, to among others, ensure removal of obsolete and contradictory clauses. That was why we raised a committee in 2016. The committee’s work has produced five amendment bills that will soon be sent to National Assembly. Our aim is that no one is left at the mercy of bad tax regime.

“I am happy at new levels of cooperation between states and the Federal Government which we have seen in the implementation of VAIDS. I am pleased to note that the number of registered taxpayers is now in excess of 19 million”.

The Vice President, according to the statement, said the embrace of technology to collect taxes and to block leakages in public expenditure—like the Treasury Single Account (TSA) and accompanying transparency in public expenditure, — are significant game changers. He compared the changes this brought about to the impact which invention of electricity had on people’s lives when it was invented.

“Osinbajo who spoke ex-tempore noted that the CITN conference held on the day when Chief Obafemi Awolowo died some 30 years ago. He noted that free education, which was funded solely from revenue from taxes, ensured a spiral in school enrolment in the old Western region-from 355,000 in 1952 when it was introduced to 811,000 in 1959. It was the highest in Africa at the time.

The Vice President noted too that key infrastructural provision in Western Nigeria: University of Ife, Airport hotel in Ikeja, 25-storey building Cocoa House building in Ibadan, several industrial estates in many parts of the Western Region, were made possible by tax money from people’s pocket.

Citing further statistics about national revenue collection, the Vice President observed that Lagos alone generates more Internally Generated Revenue than over 30 states combined. “Of the 70 million taxable individuals, only 14 million pay any form of tax. Of the 943 individuals who pay any form of Self-assessment and who pay above N10 million, 941 live in Lagos State. Two live in Ogun State.

The Vice President who observed that tax is not a subject that excites most people in the world, said tax is a social-contract question that should bind citizens and trigger robust interest in governance, accountability and democracy. He recalled that it was tax that triggered the slogan “No taxation without representation” that was the rallying cry for the American War of independence. Tax, he said, was also at the root of the riots in Aba and Abeokuta- both led by women.

He noted the gains of over N200billion which the Federal made from the deployment of technology to track ghost workers and the Treasury Single Account (TSA) from whence the Federal Government has made savings of about N4 billion monthly. This has strengthened its ability to spend more on infrastructure, he said.

The VP said the economic prosperity of Nigeria will come from taxation and encouraged taxpayers to always tax right taxes at the right time as that is the fulfilment of their responsibilities as citizens.

At the same event, the Executive Chairman of the Federal Inland Revenue Service (FIRS), Tunde Fowler, said the Service is building a robust that system that is making tax payment convenient to taxpayers both at the federal level and at the states and local government levels.

“What we are doing is to build a tax system that will not only be effective at the Federal level but also at the states and local government levels. Nobody wants to pay taxes. Not even the tax administrator. So, we have to make tax payment convenient and attractive. Attractive in the sense that people must see what you are doing with the tax money. That is what the FIRS and the Joint Tax Board (JTB) are doing”, he said.

Fowler said it is the culture of the JTB to go to the states to inspect projects that state governments are handling. By doing that, he said, “states which are not doing well get inspired by their counterparts who are using money from taxes well to build facilities for their people.

“The only way you can improve the tax system is through technology. FIRS has rolled out six-online solutions through which you can pay your taxes online (e-payment), e-receipt. You can download your receipts and authenticate the receipts using your smart phones. We have e-Stamp duties, e-filing, e-Withholding Tax e-alerts, e-payment, e-Tax Clearance Certificates, (etc).

“Our job is like that of a medical doctor, we ensure that businesses are healthy. It is when businesses are healthy that they can make profits and pay taxes.

We have changed the orientation of our staff to make them see their jobs as stewardship. We let the staff know that they are there to serve the taxpayers”.

The theme for this year’s CITN conference is Institutionalising Taxpaying Culture in Developing Economies.

CITN President, Cyril Ikemefuna, said theme for the year was crafted given the need for a change in the taxpaying culture in Nigeria”, said the statement.

Recent Comments