Former Nigerian President, Olusegun Obasanjo’s farm is named one of the tax defaulters

Nigerian tax authority names 19901 tax defaulters, bankers

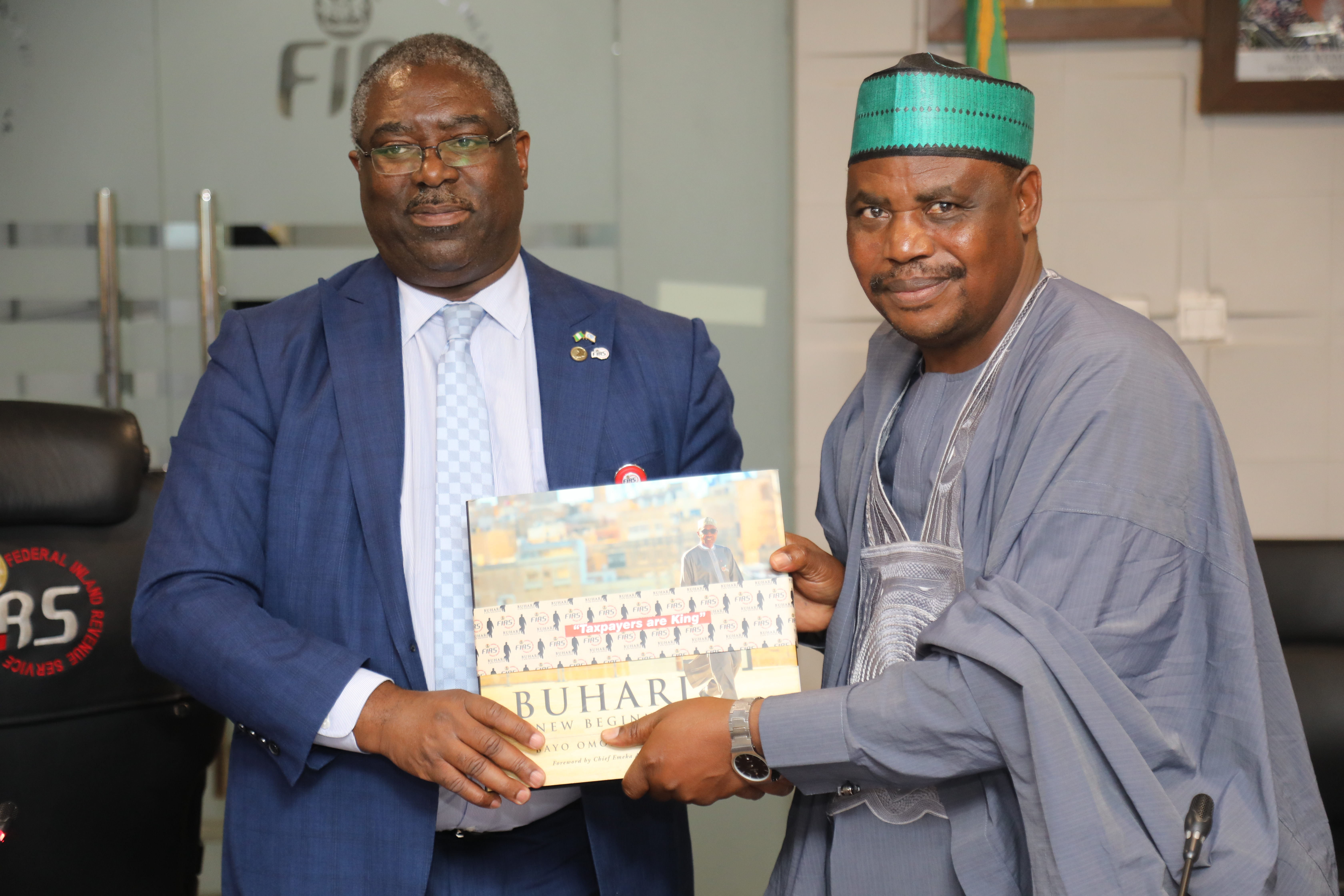

The Federal Inland Revenue Service (FIRS) has published the names and bankers of 19,901 billionaire and millionaire tax defaulters who have refused to come forward to clear their bank accounts after the tax agency placed a lien on the accounts earlier in the year. Prominent among the named tax defaulters is a business belonging to former Nigerian President, Olusegun Obasanjo, Obasanjo Farm.

Details of the companies have been published on the FIRS website: www.firs.gov.ng or through the link: https://www.firs.gov.ng/sites/Authoring/contentLibrary/e3683c47-98ea-4c8a-e2da6f7fc91fec8dCONSOLIDATED%20TAX%20DEFAULTERS-.pdf

The 19901 companies have annual turn-overs of total sums between N100 million and N 1 billion from 2016 to 2018.

To encourage tax defaulters to come forward and clear their tax liabilities, the Federal Government launched the Voluntary Assets and Income Declaration Scheme (VAIDS) in July 2017 where the government magnanimously waved the interests and penalties of all tax debts. This scheme ran for a period of one year after the deadline was extended from March 31ST to June 30th, 2018.

Some taxpayers used this window to offset their tax debts.

Before the launch of VAIDS, the FIRS in 2016 announced a tax amnesty for defaulting taxpayers with undeclared tax liabilities for three years from 2013 to 2015. To avoid the payment of tax penalties and interest for those years, taxpayers were encouraged declare their tax dues by November 24, 2016. By that deadline, taxpayers were to forward an application to FIRS and make an immediate payment of at least 25 percent of the tax due, with the remainder being payable thereafter in instalments.

While, a good number of taxpayers keyed into these windows, some others have failed to come fulfil their tax obligations.

On the 15th of February 2019, the FIRS directed bankers of affected tax defaulters to immediately suspend the lien earlier placed on the bank accounts of non-compliant taxpayers temporarily for a period of 30 days.

The FIRS explained that the suspension of the lien was due to the large numbers of taxpayers visiting FIRS offices for reconciliation and the resulting inconvenience.

The FIRS said that the it had to fall back on publishing the particulars of the tax defaulters publicly after the defaulters failed to offset their tax liabilities or come forward to claim their bank accounts.

FIRS has published the names of the tax defaulters with an advice that they come along with some documents before the Service can unban their bank accounts.

To lift the lien on the business accounts, the FIRS urged the tax defaulters to take the following steps to regularize their tax status:

Make payments of applicable taxes for the period owed; Visit the closest Substitution Review Unit (SRU) to: a) Fill Tax payers form as required; b) Attach evidence of tax payments made alongside the following: i. A letter to the ECFIRS on response to the substitution on your account; ii. Attach to letter a) Copy of your last file return; b) Copy of current tax clearance certificate; c) Bank statement for 3 years; d) Copy of incorporation and commencement of business.

The tax defaulters are also expected to: State Sources of income if Loan; or operate Bureau de Change etc.; the SRU team will analyse and give feedback or in the alternative “send these details to taxpay@firs.gov.ng.”

The FIRS had recently advertised that it would enforce the payment of whatever outstanding tax each company had against it.

In the advert, the FIRS warned that “all Companies, which had their Bank Accounts placed under Lien by the Federal Inland Revenue Service (FIRS) pursuant to Section 31 of the FIRSE Act, but are yet to regularise their tax status with the FIRS, that if they fail, refuse or neglect to pay the tax due within 30 days of this Notice, the FIRS shall in accordance with Section 49 (2) (a- d) of the FIRSE Act proceed and enforce the payment of the said tax against all the Directors, Managers, Secretaries and every other person concerned in the management of the Companies and recover the said tax from such persons without further notice”.

The FIRS also cautioned the tax defaulters that “for the avoidance of doubt, the above Section authorises the FIRS to proceed against and punish every officer, Manager, Director, Secretary or any person concerned with the management of the Company in like manner as if he/she had committed the offence.”

Recent Comments